Resources

Insights on how to master customer data management.

Checklist: Key steps to validate suppliers before procurement

Beneficial owner of a limited liability company – what applies?

Why continuous monitoring is key in customer due diligence

Ongoing due diligence plays a significant role in creating a strong and secure business environment, and it goes beyond just following rules. It is a crucial and necessary strategy for businesses dealing with the challenges of today's dynamic business world.

The difference between KYC and AML

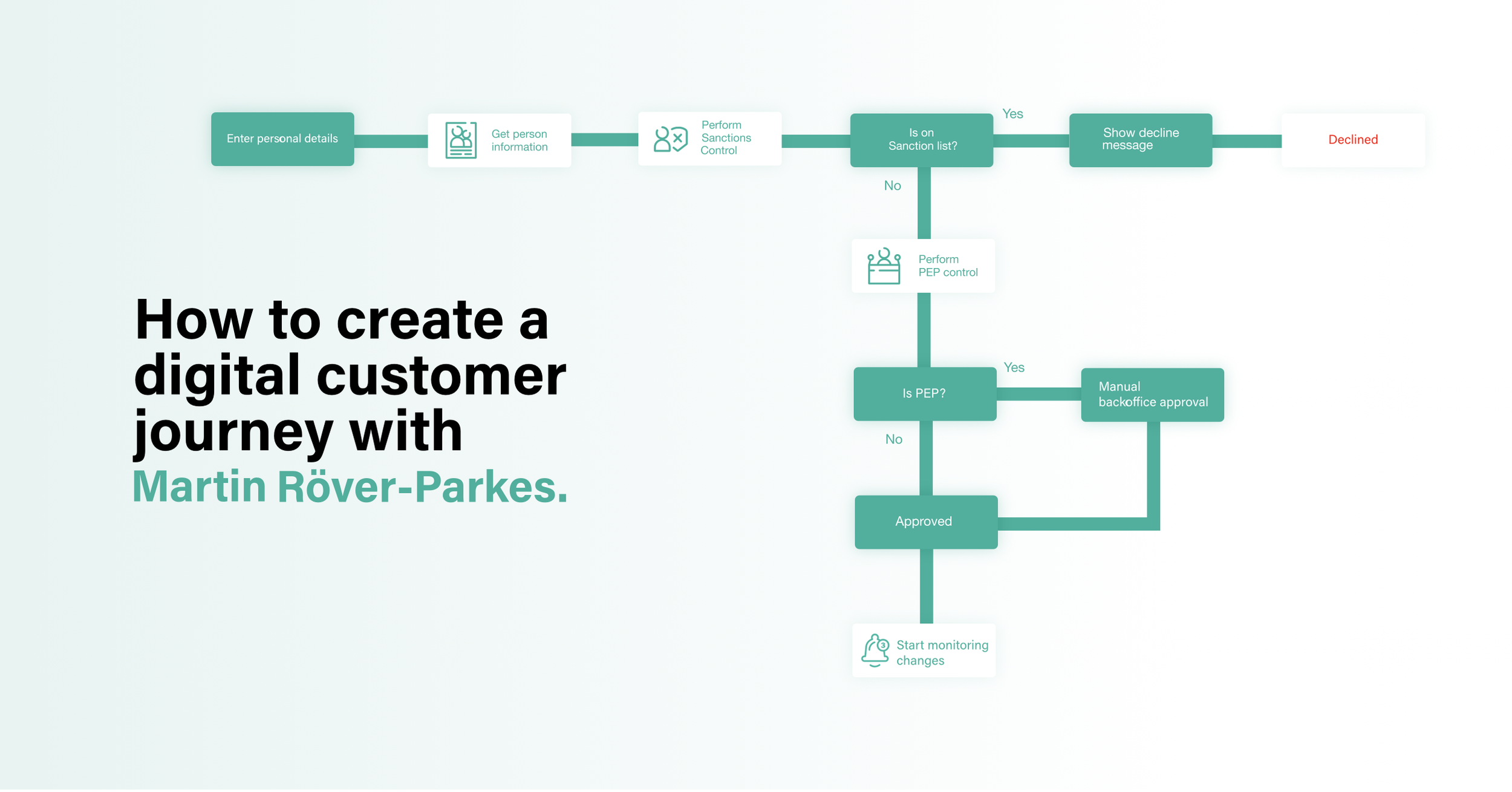

How to create a digital customer journey with Martin Röver-Parkes

Automated information in business

5 essential steps to streamline your digital onboarding with APIs

The positive effects of automation in your business

Know Your Business (KYB) – confirm the legitimacy of a company

Best practices for implementing a KYC process in your business

Digitization post Covid-19

New report from the Swedish Police Authority on exposed areas and money Laundering

Bank was granted permission to process information on legal infractions to combat money laundering

5 tips for a successful B2C onboarding

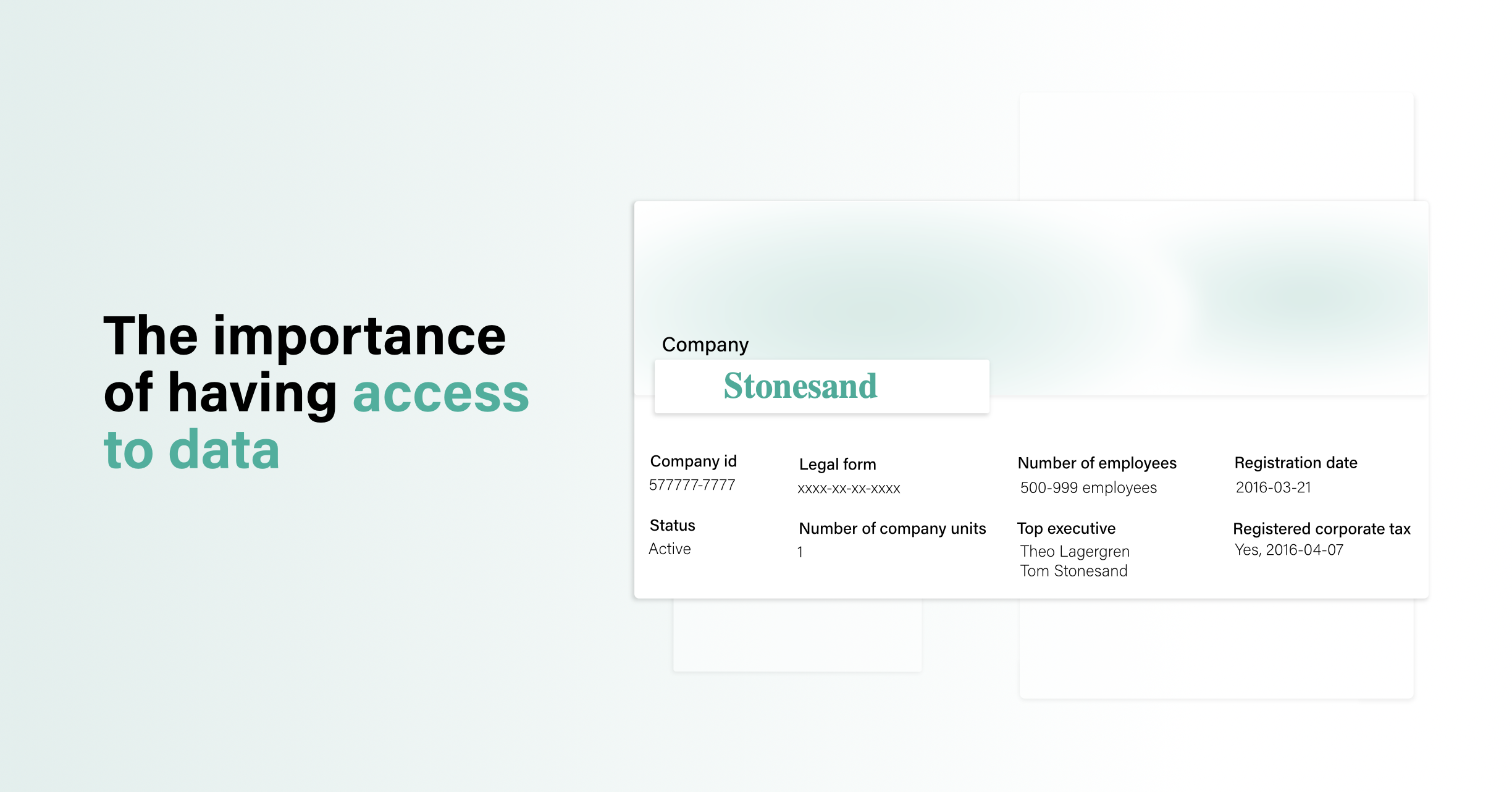

The importance of having access to data

Legal information = a vital part of business

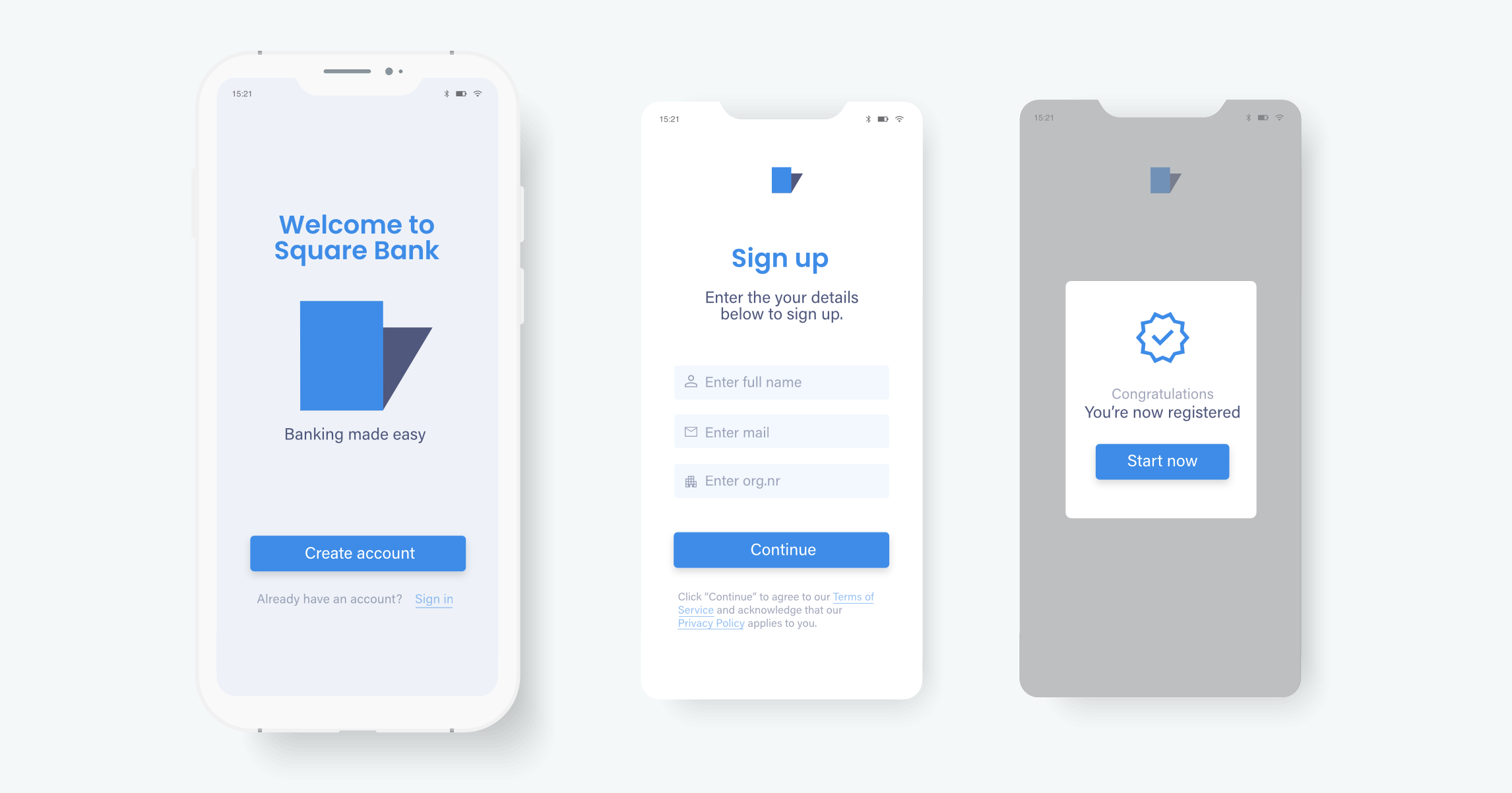

How to onboard customers in less than 5 minutes

Killing “bullshit jobs” with Antti Larvala, Visma

Benefits of having a single source of customer data truth

How Roblox can help digitize the construction industry with Lotta Wibeck, Skanska

Reports and e-books

Report: State of CDM 2021

Customer data management survey.

AML Compliance Requirements

Cost breakdown and business effects

B2B customer onboarding

How to onboard customers in a digital world.